The provision of pitches by the PR Industry to the receivers of news would appear to suffer from a significant level of inefficiency in the allocation of resources. This is due to PR suppliers charging too high a price for a given level of demand. Over supply to the most in demand journalists leads to frustration for them, and a lack of productivity and efficiency on the part of the PRs, causing reduced profitability.

To improve this situation the industry needs to invest, either internally or via external suppliers, in ways of reducing the price and/or correctly segmenting the news market such that each pitch can achieve the maximum return for the time invested.

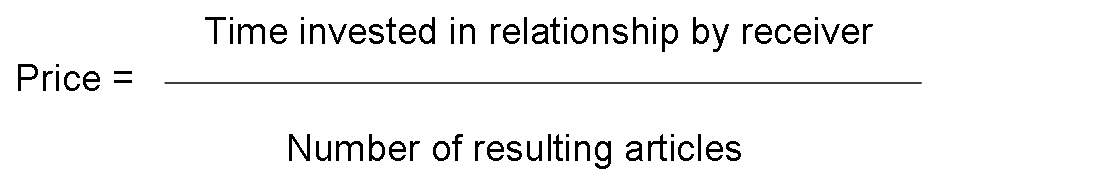

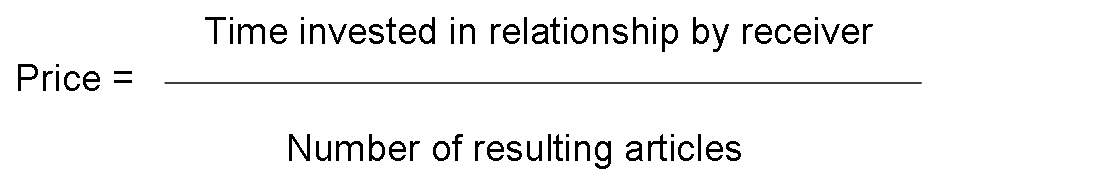

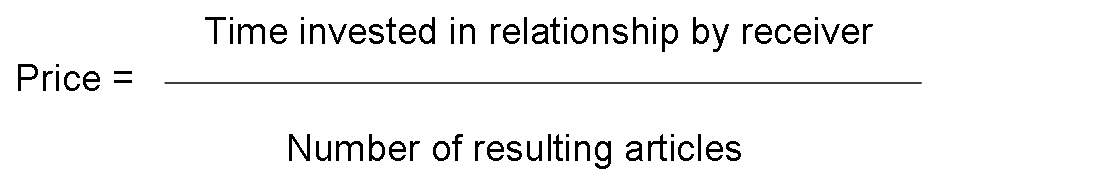

The Price of a pitch

Price in this equation is the Price a receiver of PR pitches pays per story they subsequently produce. Before I expand on this a bit of background. Andrew Smith posted last Friday on the topic of pitching and the frustration journalists experience with activities such as phone calls asking “did you receive my email”, the latest being Charles Arthur at the Guardian.

As well as being a chartered accountant I am also an economics graduate (sad I know) so I thought I would try to provide a Freakonomics like perspective on this issue – hence the equation. (By the way if anyone is as sad as me and wants some more detailed graphs etc relating to this analysis then please just let me know  )

)

Getting your story covered is an issue of supply and demand

Supply – the stories pitched by PRs.

Demand – the journalists, bloggers, editors, publishers and broadcasters need for interesting stories for their readers/audience to help fill column inches, web pages, airtime.

The receivers of news choose to write, talk about or publish- the story and therefore it is they who are making the “purchase”.

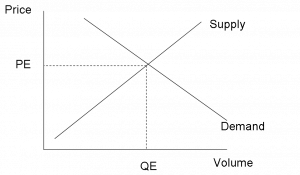

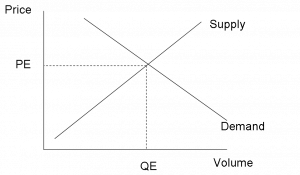

The Law of Supply and Demand

In a market supply and demand are brought into equilibrium by the price mechanism.

Suppliers want to supply more product as the price rises. Consumers demand more product as the price falls.

At the equilibrium price (PE), the equilibrium quantity (QE) is produced and consumed ensuring an efficient allocation of resources.

The “Price” of a story is a function of the time invested and interest level

From a receiver of news perspective i.e. editor, journalist etc I would suggest that the Price that the receiver of news is prepared to pay to “purchase” a story is the time I have to spend per story that I talk about or publish i.e. the equation at the start:

Investment of time includes the time it takes to review emails I receive, telephone calls made to me – chasing, pitch or otherwise – and meetings, interviews etc.

News market segmentation

The news market though is not a homogenous one. Not all receivers of pitches have the same level of demand.

(It is also worth noting that demand for PR pitches probably shifts on an almost minute by minute basis depending on the availability of other material for articles, blog posts etc but I think I should leave the concept of elasticity of demand and substitutes for another day!)

In demand journalist (Charles Arthur) scenario

The most in demand journalists are highly likely to be generating articles on their own without needing to rely on PR pitches as much for their material. Consequently their demand for pitches is low and consequently the price they are prepared to pay is low – see graph above.

The PR community on the other hand wants the most in demand journalists to talk about their pitches the most and so these journalists probably get sent the most emails, receive the most calls and yet will use the least stories because their demand is low. The effect being that the PR suppliers are expecting this market segment of consumers to consumer a high quantity of product at a high price.

The result – excess supply of pitches in this market segment.

Market implications

In reality there are multiple demand curves as there are many different types of receivers of news.

The best performing suppliers will either be the ones that are able to lower their prices across the board for all receivers and/or ones who segment the market such that they charge the right price and supply the right quantity in each.

For example a publisher of a niche market website publication who has limited in house resources to produce content may see pitches as a good source of material and therefore be prepared to pay a higher price.

Implications for the PR Industry

So how should PRs (and RealWire) seek to improve the situation for Charles and all the other receivers of releases?

Based on my formula above the Price can be reduced by

– Decreasing the investment required of the receiver

– Increasing the proportion of interesting stories they receive

Decrease investment:

To achieve this you need to do things like:

– Make sure they are as relevant as you can make them

– Ensure that the title tells the story effectively, reducing time to establish interest

– That they are in a format that makes receiving easy e.g. no attachments.

– Give them options for how to receive the pitch e.g. RSS

If you have taken the time to do these things well it is more likely that the recipient will invest the time at least reading the subject header of your email. It is then also a question of tracking usage to see if the recipients of your pitches cover any of your stories and trusting that if you have done these things well you don’t need to call everytime.

Effect? Reduced investment on the part of the recipient through reduced emails, less time to establish interest in the story and reduced phone calls.

Increase proportion of interesting stories:

This is clearly a trickier area as a lot is about message, creativity and having compelling stories to tell. I won’t get into what makes for a newsworthy story here as others could cover that far better than I.

However there are other ways of increasing the interest in your story such as using multimedia content – images, audio, video – including links to relevant websites for further information, and including background documents such as technical specifications.

Conclusion

The provision of pitches by the PR Industry to the receivers of news would appear to suffer from a significant level of inefficiency in the allocation of resources. This is due to PR suppliers charging too high a price for a given level of demand. Over supply to the most in demand journalists leads to frustration for them, and a lack of productivity and efficiency on the part of the PRs, causing reduced profitability.

To improve this situation the industry needs to invest, either internally or via external suppliers, in ways of reducing the price and/or correctly segmenting the news market such that each pitch can achieve the maximum return for the time invested.