LinkedIn has launched a tool, LinkedIn Trending Content, that lets you see the content that has been shared the most by different sections of its community. The site is currently showing the most shared URLs between 1/3/14 and 22/3/14.

Its an interesting tool for identifying the articles, and related topics, that have generated the most reaction in different groups.

It also provides the basis for a few other observations:

LinkedIn Publishing Platform content ranks very highly

In three groups – Students, High-Tech and Health & Pharma – the top ranked article is one that has been published on LinkedIn’s own Publishing Platform.

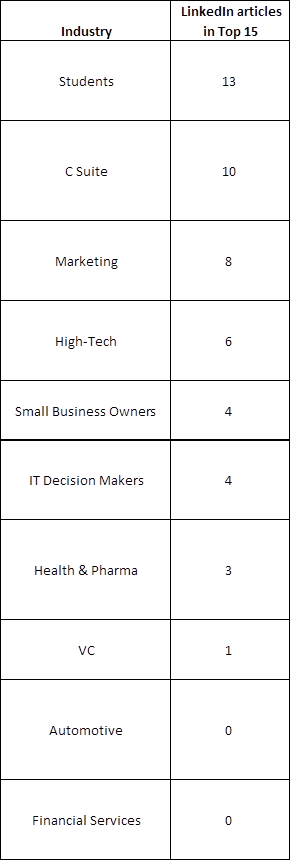

8 out of the 10 groups have at least one LinkedIn article in their Top 15 and in the case of Students, C-Suite and Marketing more than half of the Top 15 are from LinkedIn.

Only the Automotive and Financial Services groups have no LinkedIn articles in the Top 15. An opportunity there for someone?

In total 49 out of the 150 results are from LinkedIn (there are a couple of duplicates in there). I haven’t had the time to count the results for all the other individual sources but a quick scan suggests that none of them have more than 10.

17 shares are enough to trend in Automotive

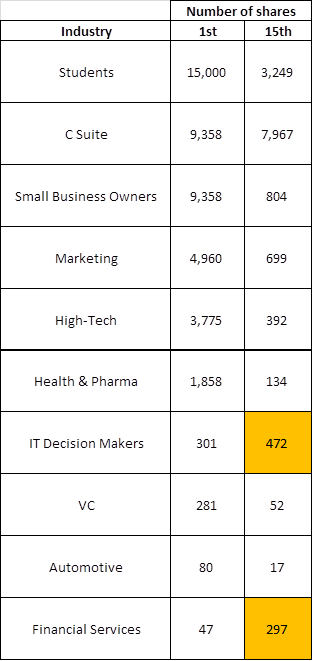

The table below shows the number of shares on LinkedIn as a whole that the articles ranked 1st and 15th (the lowest position shown) in each section have received.

I assume the tool’s ranking is based (sensibly) on shares by members of the specific section e.g. Health & Pharma, concerned. This explains the instances shown in orange – IT Decision Makers and Financial Services – where the 15th placed article has received more shares overall than the 1st placed.

This must be because less of their shares were within the specific section being evaluated e.g. the 15th ranked article in Financial Services must have received less than 47 of its 297 shares in this specific section or it would have to outrank the 1st article.

The interesting takeaway for me is that the more specific groups – High Tech, ITDM, Health & Pharma, Automotive, Financial Services and VC (with the exception of Marketing) – all require less than 500 shares across the entirety of the 270million+ members in order to rank in the top 15. In Health & Pharma, VC and Automotive it’s less than 150.

In a measurement context therefore a piece of content in any of these areas that is receiving tens of shares would appear to be significant.

US content dominates

All of the top ranked articles are from US sources and a quick scan of the others in each section suggests this is the case across the board. No great surprise given that US members are the biggest group at around 30% of the total.

Articles checked for share stats

Students

1st How to Answer Stupid Job Interview Questions

15th How To Become A Jedi Knight

C Suite

1st 18 Things Highly Creative People Do Differently

15th Confidence. Conviction. Charisma: The Art of the Sale.

Small Business Owners

1st 18 Things Highly Creative People Do Differently

15th 5 Hashtag Tracking Tools for Twitter, Facebook and Beyond

Marketing

1st Behind the Preplanned Oscar Selfie: Samsung’s Ad Strategy

15th 5 Business Goals of Content Marketing

High-Tech

1st Big Data: The 5 Vs Everyone Must Know

15th Is Microsoft telegraphing the demise of Windows Phone?

Health & Pharma

1st Saying Goodbye to the Old World of Healthcare

15th A Third Of Nursing Home Patients Harmed By Their Treatment

IT Decision Makers

1st How to Build Trust as a New IT Executive

15th 6 IT Strategies to Stay Ahead of Data Center Trends

VC

1st New York VC Investments Top $1B In The First Quarter

15th The Top Venture Capital Investors By Exit Activity – Which Firms See the Highest Share of IPOs?

Automotive

1st First Times Drive: 2015 Audi A3 e-tron plug-in hybrid

15th Hyundai Revamps Sonata That Upgraded Carmaker’s Image

Financial Services

1st Employee’s Whole Life at-a-glance

15th Should I Rent My House If I Can’t Sell It?