Not the kind of headline you might expect from the Chief Executive of a press release distribution service! But this is one of the implicit findings of PRNewswire’s research published on Tuesday and commented on by Todd Defren, comparing their news release distribution service with three of their competitors – Businesswire, Marketwire and Globenewswire (previously Prime Newswire).

It was tempting when this story first broke to respond with a post that shouted about how;

1. We achieve much better results than the ones stated in this survey – of course I would say that ![]() but I can and will prove it

but I can and will prove it

2. The methodology and interpretation of the survey itself are questionable

3. That the arguments about visibility are flawed as they take no account of the relative amount of content (releases) each site has

I am going to address 1 and 3 in a follow up post in the next couple days and others have already pointed out the issues around 2 in the related tweets and comments on Todd’s blog post, so I won’t repeat them here.

But the real story IMHO and the reason why I have waited a few days before posting is I am amazed that no one seems to have focussed on the fact that the largest (?) press release distribution company in the world has just made a “landmark” announcement implicitly stating that 45% of the press releases it sends are never picked up by anyone and that across all four of these services the figure is over 50%. The words elephant and room come to mind.

So in numerical terms what does this mean?

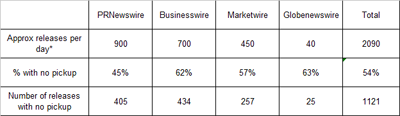

The table below analyses:

1. The approximate number of releases that each of these companies sends per day (based on their main “.com” websites)

2. The % with no pickup (the inverse of the PRNewswire pickup figures)

3. The estimate of the number of releases per day that therefore aren’t picked up

*based on the approximate number of releases on each company’s “.com” website on 23rd September e.g. prnewswire.com

*based on the approximate number of releases on each company’s “.com” website on 23rd September e.g. prnewswire.com

I realise that to give a more accurate figure I should be basing my analysis on a lot more days than one but given the results I think the scale is still likely to be in the right ball park. The result is an estimate of 1,121 releases per day or an average of 54% of releases sent that aren’t picked up. Assuming the vast majority of releases are sent Monday-Friday then a multiple of around 250 seems reasonable to use to estimate the number per year which gives approximately 280,000. 280,000 press releases a year that are sent by these companies to recipients who aren’t interested in talking about them.

When did the PR and media industries become so accepting/jaded that this hasn’t become the real story? Tens of millions of dollars will be being spent on employing these companies to generate hundreds of millions of emails that are of insufficient relevance to the recipients that they don’t want to write about them. How is it that the big wire services are not embarrassed by these statistics?

In the meantime a question needs to be asked:

At what threshold of pickup, or lack of it, are you just spamming people?