Click on image for larger version of graph

There’s been a lot of talk in the last couple of weeks about PR finding it tough. Chime Communications and Huntsworth have both announced that their 2011 results are likely to be affected by the apparent slowdown in economic activity.

There’s been a lot of talk in the last couple of weeks about PR finding it tough. Chime Communications and Huntsworth have both announced that their 2011 results are likely to be affected by the apparent slowdown in economic activity.

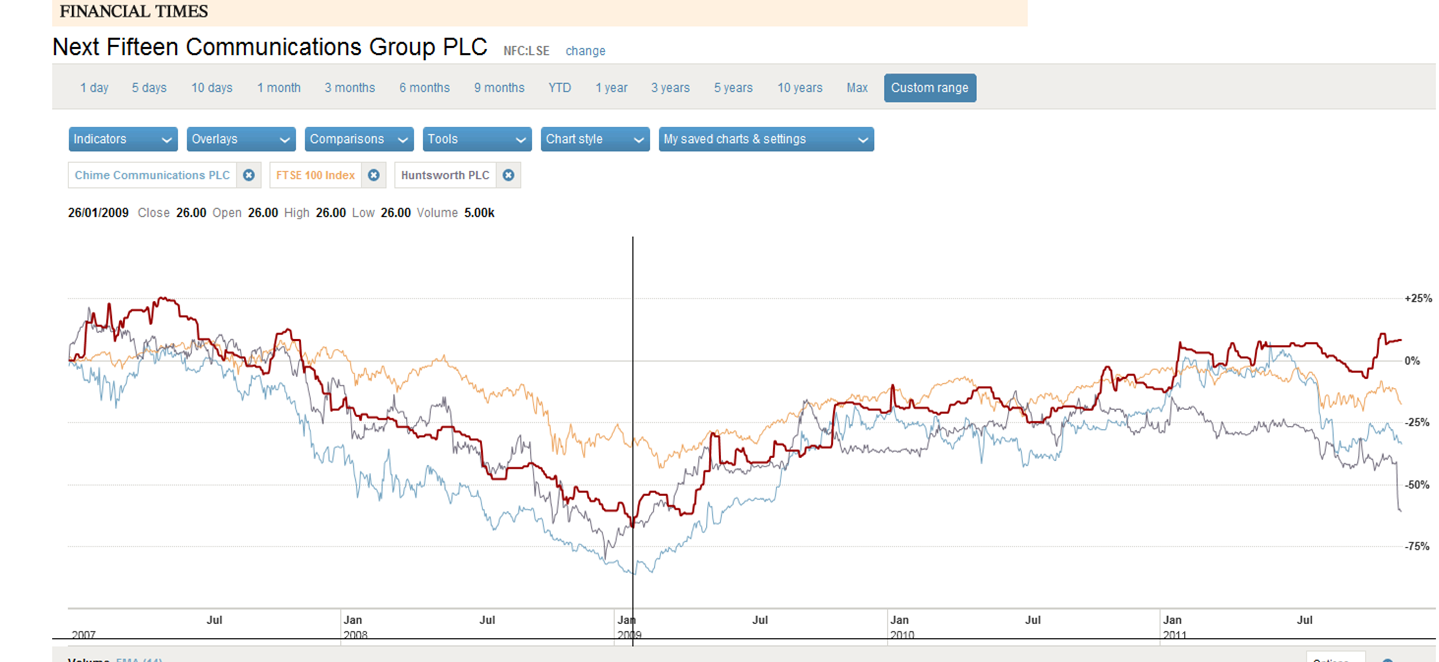

It isn’t just PR that’s finding things tough. Huntsworth is a PR group, but its worth remembering that only approx 50% of Chime’s revenues (though 60% of its profits) come from PR, the remainder from other marketing services and the share prices of the major multinational Marcoms groups have also taken a bit of a battering over the last few months.

As of 28/11/11 (16.50) some examples of these reductions from their 52 weeks highs are – WPP (-25.3%), Omnicom (-19.2%), Interpublic (-33.5%), Havas (-32.0%), Aegis (-29.6%) and Publicis (-19.8%).

This contrasts with the FTSE100 which was down around 13% against its 52 week high the same time this afternoon. Not that surprising as Marcoms usually underperforms in falling markets and overperforms in rising ones.

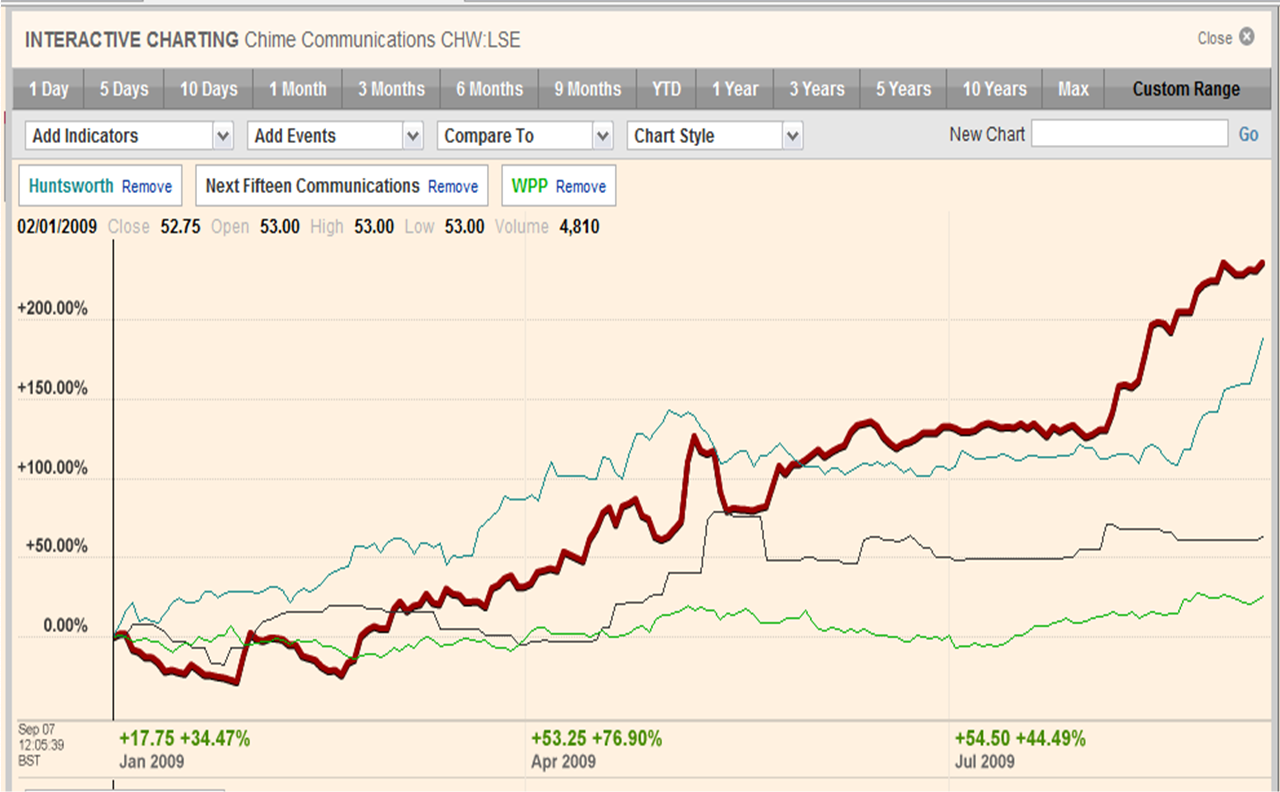

But as the graph above shows one quoted PR company has been bucking the trend. Next Fifteen is actually trading at a higher level than it was at the start of 2007 something none of the others can claim except for Publicis.

Next Fifteen is also the only one of these PR or Marcoms groups whose share price is up in calendar year 2011 (15%). Now obviously Next Fifteen is significantly smaller (market capitalisation £49m) than even Huntsworth (£90m) and Chime (£148m), nevermind the multinational groups but that doesn’t mean that outperforming the market is therefore easier.

In the Evening Standard a couple of weeks ago Tim Dyson, Next Fifteen’s CEO, put their success down to investment in digital and social media. In the analysis of the PR industry for 2010 that I helped the Holmes Report put together earlier this year the biggest success story was Edelman, (arguably) the first of the major PR brands to embrace digital, which climbed to the No.1 spot in the Holmes Report Global Rankings.

So perhaps this evidence demonstrates that though we can almost certainly expect another challenging year in 2012, there is still success to be found and particularly for those elements of the PR industry that are making digital core to their business.