I thought it was about time I turned my attention back to some good old analysis of numbers. With all the talk about the prospects for 2009 and following on from my analysis of the PRWeek Top 150 I thought I would try and have a look into profitability. But then I thought, why stop there? Why not use my financial skills to come up with some practical suggestions for improving profitability in these challenging times and being an accountant I have even created a spreadsheet so you can test the veracity of my conclusions

As I have already commented, profitability is much harder to get figures on than income. However if one uses income per staff member as a proxy you can start to build a model of the underlying picture.

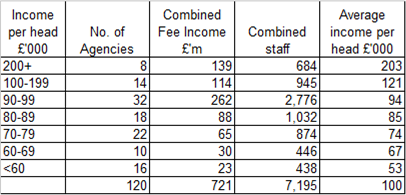

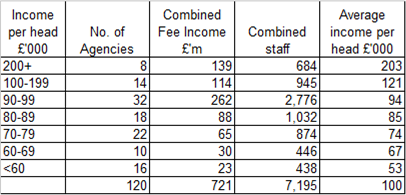

The table below summarises the income per staff member of the 120 agencies within the 2008 Top150 that are based in London or the Home Counties. I have selected these on the basis that they should have relatively comparative cost bases – all things being equal – a simplifying assumption I accept.

PRWeek Top 150 Income Per Head

The combined fees of these 120 agencies – £721m – represents 92 percent of the whole of the Top 150.

So what do these figures tell us about profitability? An MD of an agency – name withheld  – told me recently that £100,000 per staff member was a target figure to achieve circa 20% profitability. It also happens to be the overall average for these 120 agencies – coincidence? Anyway having reviewed the staff costs and margins disclosed in a few of the larger agencies’ accounts I suspect these figures may be a bit on the aggressive side. My guess is nearer 10 – 15 percent at £100,000.

– told me recently that £100,000 per staff member was a target figure to achieve circa 20% profitability. It also happens to be the overall average for these 120 agencies – coincidence? Anyway having reviewed the staff costs and margins disclosed in a few of the larger agencies’ accounts I suspect these figures may be a bit on the aggressive side. My guess is nearer 10 – 15 percent at £100,000.

Now obviously different agencies will have different cost structures e.g. premises costs could vary significantly depending on location, but they would suggest a cost base per head of around £80,000-£90,000.

Fight the recession; increase efficiency

From the table we can see that this means that as many as 66 out of 120 agencies might have been struggling to do much more than break even in 2007, the year these figures would have related to (i.e. ones with per head fees of below £90,000). These agencies have a combined income of £206m and employ approx 2,800 people i.e. one in three of the staff in these 120 agencies.

Others have already asked how the recession will affect the PR industry. The above analysis would suggest the first question to ask in return might be how does the industry become more efficient and increase its fee income per head at the same time?

Now I am not naive. I realise that unfortunately these numbers may suggest that there could be some pain on the way, in terms of potential job cuts, for some amongst these firms. However I prefer to drink from a half full glass and see this challenging time as potentially an opportunity for the industry to try and improve this situation in a positive way.

Outsource process work; focus on better audience engagement

I would suggest that there are two areas that could be focused on. Firstly **disclosure here I have a vested interest in this** the industry could benefit from making better use of outsourcing solutions and technology to fulfil more process driven requirements – administration, database building and maintenance, distribution, tracking, reporting, project management/collaboration etc.

This would increase the flexibility of its cost base in these times of uncertain demand and benefit from the potential for these organisations to have better economies of scale and potentially lower overheads and people costs, particularly if they aren’t located in the South East.

The second is to focus on the areas where PR can achieve the most value for the time spent. IMHO (and apologies here to anyone who thinks who is this accountant to tell us PR professionals how good PR works!) I would suggest there is greater value to be secured, for client and agency, by spending more time on:

– identification of the dialogue/s organisations should be having;

– better targeting of the relevant communities they should be conversing with;

– using their creativity to engage with these communities in a more effective and influential way; and

– listening to and learning from these conversations and to the extent that one can, measuring them.

Perhaps this seems like stating the obvious, but I do wonder what proportion of a lot of PRs’ time is actually spent on these activities compared to process tasks as a survey in PRWeek found last year.

A high proportion of this process based work is carried out by more junior staff. A great opportunity exists for instance to employ this capacity in these higher value areas in helping clients engage in the online world, as it is these very staff that are often most comfortable engaging and conversing in online communities.

Greater value; increased profitability

The effect of these two things would be to increase the potential value per head on the one hand and free up the capacity to do more of this higher value work at the same time. It would also have the added benefit of potentially more motivated staff that are doing more creative work. The top three causes of job dissatisfaction in the Aurum survey being repetition of the same tasks, length of working hours and volume of administration.

My detailed analysis – worked example can be downloaded here, spreadsheet tool here – would suggest that the following could be achieved:

1. More value for the client due to time being spent on added value activities.

2. Improved margins for the agency.

3. Increased motivation and productivity from staff due to reduced hours and more interesting and rewarding work.

What do those who have first hand experience of this think? Am I living on a cloud with the proverbial cuckoo?

Stephen Waddington MD of the newly born (from the merger of Loewy’s PR firms) Speed Communications, posted yesterday about the recession and as he so clearly put it “bollocks to denial and despair”. I started writing a comment and then realised it was getting rather lengthy, so hence this post. I strongly advise you to read it first.

Stephen Waddington MD of the newly born (from the merger of Loewy’s PR firms) Speed Communications, posted yesterday about the recession and as he so clearly put it “bollocks to denial and despair”. I started writing a comment and then realised it was getting rather lengthy, so hence this post. I strongly advise you to read it first.