PRWeek and the PRCA announced the results of their PR Census a few weeks ago now. One of the key headline numbers was their estimated turnover of the UK PR Industry – £7.5bn.

I wanted to clarify how this number was reached and Cathy Bussey at PRWeek was kind enough to put me in touch with the senior researcher at Harris Interactive who put together the analysis.

He was most helpful and from our discussions I established that the £7.5bn represents the estimate of the total amount spent on PR both in house and with external agencies and freelancers.

UK PR Industry PR Census split

The split between in house and advisory is:

In House – £5.5bn

Agency/Freelancers – £2.0bn

The estimates were reached through the use of a combination of data including census returns, Office of National Statistics Data and the PRWeek Top150. With regards to the Agency/freelancer market figure of £2bn my view is that it is probably at the higher end of the likely range of estimates (as I will indicate below), but from my discussions the methodology behind it seems reasonable.

On the face of it two immediate implications are apparent. The vast majority of PR is delivered from in house resources (73 per cent of the total) and the agency/freelance market is highly fragmented.

The “highly fragmented” implication being due to the PRWeek Top 150 agencies with a combined income of £839m accounting for 42 per cent of the total UK agency/freelance market with no one agency in the Top 150 accounting for more than 3.3 per cent of the total market – Bell Pottinger – and even they are arguably a collection of agencies under one umbrella.

However these conclusions would represent an over simplification of the market.

Many Markets

When people talk about “the housing market” I often sigh because such a thing doesn’t really exist. In reality there are a lot of micro markets dependent on type of property and geography, even down to street level in some cases. In a similar way, as any agency MD/owner would tell you, the PR advisory market isn’t one homogenous beast.

At a very basic level it breaks into two main areas:

1. The small number of larger agencies almost exclusively based in the London Metro area competing for the accounts of large, often multinational, companies in the main where breadth of service areas, international capability and established brand can often be hygiene factors. These large companies will almost always have significant in house PR capability compared to SME’s meaning that external PR spend as a proportion of in house spend in this large company market will probably be quite a bit lower than the overall 27 per cent figure. Competition is therefore still very high despite the small number of participants as clients in house capability means they still hold the majority of the cards.

2. The remainder of the market where a very high volume of participants compete in individual micro markets driven by geography, sector and/or service area. In these markets the purchasers of external support will generally have much lower levels of in house PR capability (potentially none) and so the spend on PR will almost certainly represent a much higher proportion of total spend than the 27 per cent average. This can lead to these clients relying more heavily on their PR advisers, though this is very dependent on the particular micro market and how differentiated an individual agency/freelancer is in that market.

The £2bn overall estimate gives us a basis to estimate the potential split between these two broad market areas and equally these definitions provide a framework to test the reasonableness of the £2bn estimate itself.

Large Company Market

Firstly on the large company side we can look to establish a likely cut off point in agency size terms based on market share.

A bit of additional analysis on the PRWeek Top150 relating to the holding companies of agencies establishes the following list of 16 groups or individual agencies who would have market share of 0.5 per cent or more if the total UK agency/freelance PR market is £2bn. (Note many of these numbers are estimated by PRWeek within the Top 150 as the agencies don’t provide specific numbers – full details here)

| Revised position |

Company |

Income £’000 |

UK Market % |

|

| 1 |

WPP agencies¹ |

91,600 |

4.6% |

|

| 2 |

Bell Pottinger Group |

67,818 |

3.4% |

|

| 3 |

Omnicom agencies² |

57,500 |

2.9% |

|

| 4 |

Huntsworth agencies³ |

55,663 |

2.8% |

|

| 5 |

Brunswick |

53,200 |

2.7% |

|

| 6 |

Interpublic agencies4 |

37,500 |

1.9% |

|

| 7 |

FD |

31,000 |

1.6% |

|

| 8 |

Edelman |

28,777 |

1.4% |

|

| 9 |

Freud Communications |

23,800 |

1.2% |

|

| 10 |

Engine Group |

22,252 |

1.1% |

|

| 11 |

MS&L Group |

20,000 |

1.0% |

|

| 12 |

College Hill |

16,730 |

0.8% |

|

| 13 |

Havas agencies5 |

14,500 |

0.7% |

|

| 14 |

Photon agencies6 |

13,330 |

0.7% |

|

| 15 |

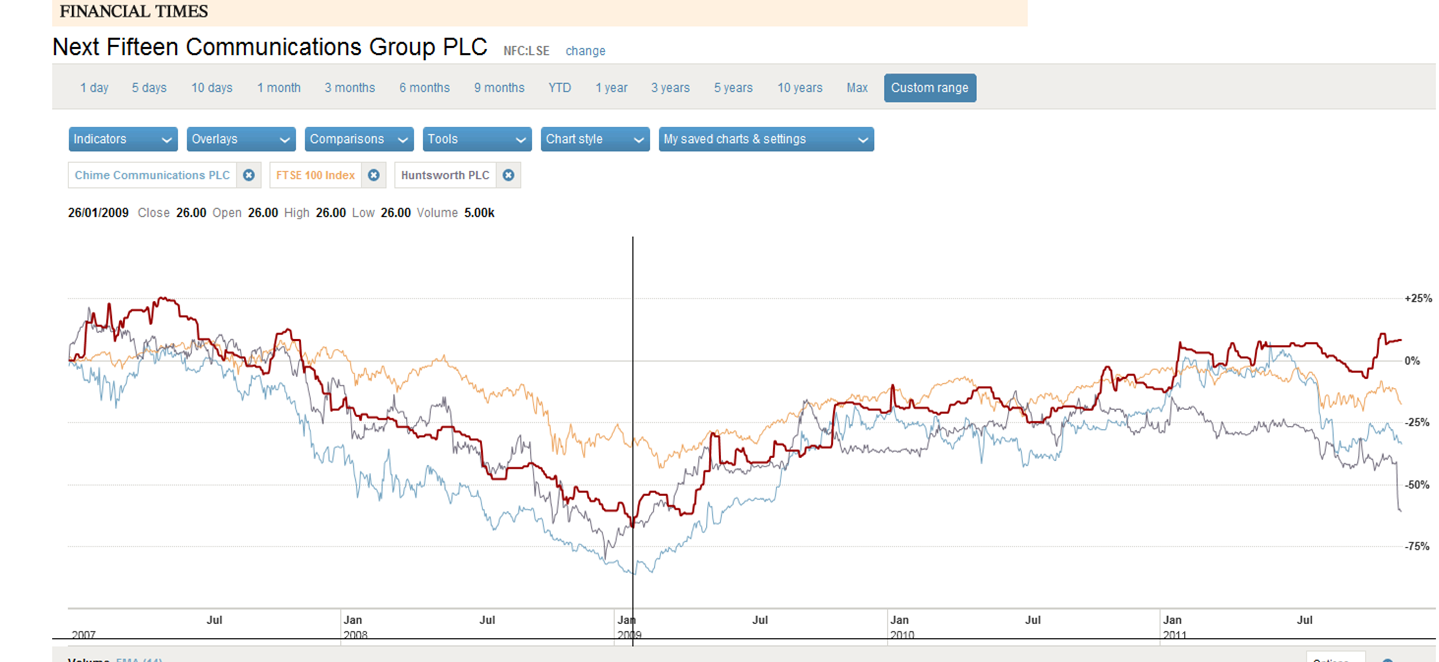

Next Fifteen agencies7 |

11,858 |

0.6% |

|

| 16 |

Chandler Chicco Companies |

10,602 |

0.5% |

|

|

Total |

556,130 |

27.8% |

|

See Notes below for agencies within each group.

This analysis makes WPP the single largest player in the UK PR market with 4.6 per cent of the market.

Obviously agencies (and freelancers) that are smaller than the £10m (0.5 per cent) cut off I have used above can still often win work with large companies, particularly if they have an area of clear differentiation either around sector or service specialism. If you include agencies with income of greater than £3m (0.15 per cent of the total market) from the PRWeek 150 table these would add an additional £144m between them giving £700m in total.

Two other factors need to be taken account of to reach our estimate of the large company market. Firstly not all sizeable agencies are in the Top 150 (though the vast majority are) and in addition there will be some PR services being provided to large companies by teams within agencies of other types e.g. digital marketing, SEO and social media. (Equally it is worth bearing in mind that some of the PR agencies concerned could be providing some marketing and SEO services within their own figures). As a complete finger in the air estimate to compensate for this if we make an allowance of £100m this would imply that the large company market is approx £800m in total.

For information if we now restate the table above based on an estimate of £800m for the large company market you get the following market share figures for the largest groups/agencies in this market:

| Revised position |

Company |

Income £’000 |

UK Large Co. Market % |

| 1 |

WPP agencies |

91,600 |

11.5% |

| 2 |

Bell Pottinger Group |

67,818 |

8.5% |

| 3 |

Omnicom agencies |

57,500 |

7.2% |

| 4 |

Huntsworth agencies |

55,663 |

7.0% |

| 5 |

Brunswick |

53,200 |

6.7% |

| 6 |

Interpublic agencies |

37,500 |

4.7% |

| 7 |

FD |

31,000 |

3.9% |

| 8 |

Edelman |

28,777 |

3.6% |

| 9 |

Freud Communications |

23,800 |

3.0% |

| 10 |

Engine Group |

22,252 |

2.8% |

| 11 |

MS&L Group |

20,000 |

2.5% |

| 12 |

College Hill |

16,730 |

2.1% |

| 13 |

Havas agencies |

14,500 |

1.8% |

| 14 |

Photon agencies |

13,330 |

1.7% |

| 15 |

Next Fifteen agencies |

11,858 |

1.5% |

| 16 |

Chandler Chicco Companies |

10,602 |

1.3% |

|

|

556,130 |

69.5% |

These figures suggest that this large company market is actually quite concentrated when you take account of holding company groups with the top 10 accounting for almost 60 per cent.

Micro markets

The large company estimate of £800m would leave approx £1.2bn of the £2bn overall which would then relate to the second category of micro markets.

Ignoring sector or service specialism and just focussing on geography within these micro markets then the largest of them unsurprisingly is the London Metro area with the remaining PRWeek Top 150 entrants with income of less than £3m predominantly still based here – £109m out of £139m or 79%.

The unknown factor here is what proportion of the London Metro area market do these agencies account for? If for arguments sake we said it was half then this would give an estimate for this micro market of approx £200m+.

This would mean the large company market (mainly serviced from within London Metro) and the smaller company London Metro markets would be approximately £1bn combined. In turn implying the remaining micro markets for the rest of the UK would then account for approx £1bn.

(Interesting to note that the London Metro region accounts for an estimated 30 per cent of UK GDP and yet apparently at least 50 per cent of UK PR activity)

It is this implied figure for the regions of £1bn that leads me to think that the overall £2bn estimate may be on the high side. Evidence for this comes from the PRWeek Regional agencies rankings.

Regional element

Manchester based agencies have the largest combined income in the PR Week regional list with £12.2m and no other city represented on the list has more than £10m. There are 17 cities in the UK outside of the London Metro area with populations of more than 250,000 the average of which is 427,000. The following table shows their population and the combined income total of PR agencies in the Top 40 Regional List that are based there.

|

City

|

Population

|

Combined Regional Top 40 value £’m

|

| Birmingham |

992000

|

4.4 |

| Leeds |

720000

|

3.5 |

| Glasgow |

560000

|

7.3 |

| Sheffield |

512000

|

|

| Bradford |

467000

|

|

| Edinburgh |

450000

|

4.4 |

| Liverpool |

440000

|

0.8 |

| Manchester |

420000

|

12.1 |

| Bristol |

380000

|

1.7 |

| Wakefield |

316000

|

|

| Cardiff |

310000

|

9.0 |

| Coventry |

305000

|

0.8 |

| Nottingham |

285000

|

|

| Leicester |

280000

|

|

| Sunderland |

280000

|

|

| Belfast |

280000

|

|

| Newcastle upon Tyne |

259000

|

0.9 |

These regional markets may be highly fragmented and freelancers may account for a much higher proportion of PR services in these areas. It also seems likely that a lot more PR services may be provided by agencies/freelancers who would have a broader marketing remit and so wouldn’t fall under the definition of “PR agency”. Consequenty these ranked agencies may only account for a relatively small proportion of the PR services provided in their area. However given the regional rankings it still seems unlikely that even the largest of these regional markets is measured in more than tens of millions. For the purpose of this exercise if we therefore assume the market size for the average of these cities is £25m you would get a total estimate for these larger regional markets of £425m.

This would give a total for large companies, London Metro and the main regional centres of approx £1.4bn. With the remainder of the country being likely to be fairly limited in market size terms it does seem that the £2bn overall figure looks a bit of a stretch. This analysis suggests an overall estimate of £1.6bn might be nearer.

On the other hand the analysis could be understating the large company market (is £100m enough for missing entrants in the PRWeek 150 and other types of agency?), the smaller company London Metro market could be substantially more than £200m (do the PRWeek entrants count for less than 50 per cent?) and perhaps the regional agencies really do only account for a very small proportion of their local markets.

Without detailed returns from everyone this is always going to be a difficult task and the research for the PRWeek/PRCA Census was certainly thorough so perhaps we can agree that a figure of £1.8bn +/- 10% is a fair range.

Notes

Agency groups

1. Finsbury, Hill and Knowlton, Ogilvy Health, Cohn & Wolfe, Burston Marsteller, Buchanan, Ogilvy, Clarion Comms

2. Ketchum Pleon, Fleishman Hillard, Fishburn Hedges, Porter Novelli, Kreab Gavin Anderson

3. Grayling, Citigate, Red, Tonic Life

4. Weber Shandwick, Golin Harris

5. EuroRSCG and Maitland

6. Frank, Hotwire

7. Lexis, Bite