At RealWire we have recently become aware that a major wire service is making a big deal out of their website’s high traffic numbers. In fact they have been specifically targeting the market trying to argue that their service is hugely better where visibility is concerned.

However they don’t mention the following three crucial issues about the traffic to their site.

1. That volume of traffic is clearly going to be affected by quantity of content.

2. The time visitors actually spend reading their content.

3. The relevance of those visitors to the content.

At RealWire we are always keen to make sure that discussions are based around the facts so let’s look at each of these in turn to see how our readership, engagement and relevance are all in fact apparently superior to Big Wire Corp’s.

Quantity of content

Q: Which is the more “popular” of the following two sites?

Site A – 1 piece of content and 1,000 page views in a month

Site B – 1 million pieces of content and 1 million page views in a month

Well according to their literature Big Wire Corp would apparently see Site B as a more popular destination because it has 1,000 times more page views. Makes sense, bigger is better right? Wrong.

Site A’s one piece of content has been viewed 1,000 times, whereas each of Site B’s stories has only be viewed once on average. Now which site is more popular? Site A of course.

Now let’s apply this concept to Big Wire Corp’s website.

First of all let’s get an idea of volume of content. The Google “Site:[url]” command gives you the number of unique pages indexed by Google on a particular site – a good proxy for the amount of content.

In this case the answer is 406,000.

Next we need an idea of traffic to the site. Google AdPlanner provides estimates of monthly page views.

In this case the answer is 7.5 million

I we then divide page views by content, we get an estimate of the number of views per article per month. Answer 18.5.

RealWire’s equivalent data from the same sources is

Content – 5,500

Page views – 200,000* (less than 3% of Big Wire Corp’s figure)

This gives 36.4 page views per article per month.

Twice the Big Wire Corp figure suggesting RealWire has higher readership for each article.

*I happen to know that the page view figure is too high in RealWire’s case (we do have analytics of course) but it could equally also be so for Big Wire Corp and so until I can get a hold of actual numbers for them I am being consistent.

Engagement

Q: Which of these two sites is engaging its readership the most?

Site A – average time spent on each page 2 minutes

Site B – average time spent on each page 5 seconds

Site A obviously. Each of the readers are spending 24 times longer reading an article on average than on Site B.

So let’s apply this to Big Wire Corp again.

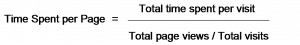

Again Google AdPlanner can help. It tells us how many visits the site receives and how long each one lasts. From this we can get Time spent per Page as follows:

Big Wire Corp numbers

Time spent per visit = 3 minutes 50 seconds (230 seconds)

Total page views = 7.5 million

Total visits = 3.5 million

Time spent per page = 107.5 seconds or 1 minute 47.5 seconds

RealWire numbers

Time spent per visit = 8 minutes (480 seconds)

Total page views = 200,000

Total visits = 64,000

Time spent per page = 153.6 seconds or 2 minutes 33.6 seconds

43% more than Big Wire Corp suggesting readers of RealWire content are more engaged.

Relevance

Q: Which of these two sites is most likely to have the most relevant readership to a UK relevant story?

Site A – 100% of visits from the UK

Site B – 1% of visits from the UK

A: Site A – Yes I know these are getting ridiculously easy now!

Big Wire Corp’s market report focusses on US usage of their site when comparing themselves to others such as RealWire. However given that the vast majority of their content is from US companies it will come as no surprise that the vast majority of their traffic does as well. Google Ad Planner again helps us out.

US traffic – 76% of total

But the majority of RealWire’s clients and therefore content are from the UK. So what’s Big Wire Corp’s UK traffic like?

UK traffic – 3% of total.

And RealWire’s UK traffic? Well AdPlanner estimates around 75% but the real figure is nearer 45% or 15 times the Big Wire Corp figure.

Suggesting that RealWire’s traffic is around 15 times more likely to be relevant.

Conclusion

When evaluating traffic between sites it is imperative that you don’t get drawn in by the size of headline traffic numbers and that you consider:

a) normalising traffic for levels of content

b) how engaged the readers are

c) how relevant the readers are

Or you could find yourself reaching some very misleading conclusions. Just ask Big Wire Corp

* Hattip to Andrew B Smith for highlighting the value of Google Adplanner for such analysis

PR Week published its 2010 league table of the

PR Week published its 2010 league table of the